Last year’s American Rescue Plan Act, ARPA, sent more than $10 billion to Ohio — $5.4 billion to state government and another $5.3 billion split among local governments. Before that, the Trump administration’s CARES Act sent the state $2.6 billion.

Researchers with the Ohio Poverty Law Center and Advocates for Ohio’s Future have built an online tool to track how state and local governments are spending COVID relief dollars. As reported by Nick Evans in the Ohio Capital Journal, they also have a few ideas for the nearly $2 billion Ohio has left over.

We would like to propose an idea that would address the issues and do so on an ongoing basis.

To capitalize a public bank with part of the funds and create a tool that can finance future public needs.

Public Banks

How states can establish public banks to democratize capital, build resiliency, and better leverage state funds for public purposes

By: Michael Brennan & Macabe Keliher

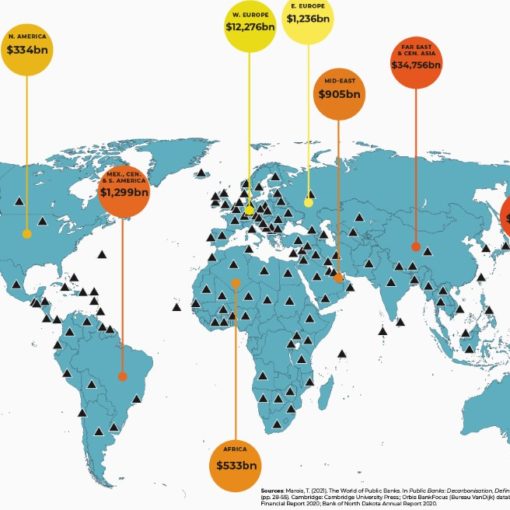

Public banks are lending and depository institutions owned and managed by a government in the public interest. They leverage public funds to create credit that serves the public in a variety of ways, from infrastructure projects to small business loans. In contrast to most large private banks, which serve private shareholders and often seek short-term profits in order to maximize payoffs for out-of-state owners, public banks keep capital local by investing in community enterprises and public projects in pursuit of the long-term economic health of the communities they serve.

In doing so, public banks help democratize the economy. By increasing the availability of productive capital in a community, giving more people and projects access to more funding, they empower citizens and communities to engage with the economy on their own terms and transform their local economies for the better.

Currently, almost every state and local government deposits their public funds in private banks. In turn, when these governments want to fund public projects, they must turn to private capital markets for financing. Public banks cut out the middleman, serving both as public depositories for government funds and as public lenders for the government’s borrowing needs, such as infrastructure projects. This means public funds are not gambled on stock markets for private gain, but invested at home in local economies with profits returning back to the public. … Read More